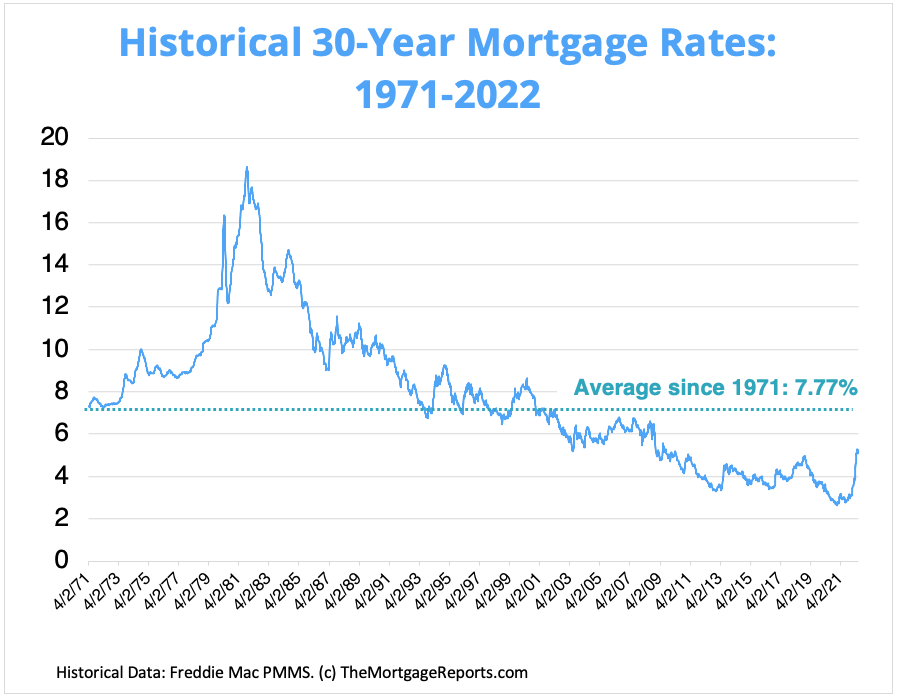

In an effort to curb inflation, the Federal Open Markets committee raised the target interest rate this month from near 0% to between 1.50 – 1.75%, an increase of .75% (as per the Fed announcement on 6/15/22). I’m often asked about the effect of interest rates and how it could affect the market. Hearing of the rise in interest rates often scares buyers, yet it’s important to look at long term data trends. Rates are still low compared to where they’ve been historically per the graph above. In short, it’s still a great time to buy.

Last week, the Fed announcement of increased target interest rates was a key headline in the news; but it’s still a good time to buy real estate, for several reasons:

- With inflation, investing in real estate is a safe, long term option.

- Interest rates are still historically low (in the 1980’s, interest rates were 20%).

- Rental inventory is scarce and rental prices are higher than ever.

- As inventory rises (which we are starting to see as listings aren’t moving quite as fast), buyers that have lost multiple bidding wars will now have an opportunity.

- While rates have gone up, buyers can still choose an arm – many of our clients do. I have bought and sold many times, and have always chosen an arm (current rates roughly 3.5% for 5/1, 4% for 7/1, 4.5% for 10/1 w cross country mortgage). You can float down when rates drop again. We are constantly refinancing / taking advantage of better rates.